The Richest Man in Babylon, first published in 1926, is a classic work on personal finance and wealth-building by George S. Clason. The book offers timeless wisdom and practical advice on financial management, investing, and achieving financial independence, all presented through a series of captivating parables set in ancient Babylon.

BOOK INFO

version: CLASSIC, EBOOK, AUDIOBOOK

number of pages: 150

literary genre: SELF-DEVELOPMENT

1st edition: 1926

years of writing: 1920s

SUMMARY

Drawing upon the ancient civilization’s reputation for immense wealth and prosperity, The Richest Man in Babylon imparts valuable financial lessons through the stories of its characters, who learn to navigate the challenges of money management and wealth accumulation. At the heart of these parables is the character of Arkad, the titular richest man in Babylon, who shares his insights and experiences with others seeking to improve their financial situations.

The Richest Man in Babylon distills its financial guidance into a series of simple, actionable principles that can be applied by anyone seeking to improve their financial well-being. These principles include:

- Paying Oneself First: Setting aside a portion of one’s income for savings and investment before addressing other expenses.

- Controlling Expenditures: Living within one’s means and avoiding unnecessary expenses to maintain financial stability.

- Making Money Work: Investing wisely and prudently to generate passive income and grow one’s wealth.

- Protecting Wealth: Safeguarding one’s assets through diversification and risk management.

- Increasing Earning Potential: Continuously improving one’s skills, knowledge, and abilities to enhance earning capacity.

- Seeking Professional Advice: Consulting with financial experts and mentors to make informed decisions about money management and investments.

- Ensuring Financial Stability for Future Generations: Planning for the long term and leaving a financial legacy for one’s family.

The Richest Man in Babylon emphasizes the importance of discipline, patience, and consistency in the pursuit of financial success. The book argues that anyone, regardless of their starting point, can achieve financial independence by diligently following its guiding principles and adopting a long-term perspective on wealth-building.

MAIN CHARACTERS

In The Richest Man in Babylon, the characters appear in the form of parables to illustrate the book’s financial principles. The main character is:

Arkad

The titular richest man in Babylon, Arkad serves as the primary source of financial wisdom and guidance in the book. He shares his experiences, insights, and the principles that have led him to accumulate great wealth. Arkad teaches others the importance of saving, investing, and managing money wisely to achieve financial success.

Bansir

A chariot builder who is struggling financially. He seeks the guidance of Arkad, who helps him understand the importance of paying himself first and living within his means.

Kobbi

A musician and friend of Bansir, who also learns from Arkad’s financial wisdom. Together with Bansir, they apply the lessons they have learned and work towards achieving financial stability and prosperity.

Mathon

A money lender in Babylon who plays a role in a parable illustrating the importance of investing wisely and assessing risks before lending money.

Dabasir

A former slave who, through determination and application of the principles taught by Arkad, manages to pay off his debts and achieve financial independence.

These characters contribute to the book’s narrative by embodying the financial principles and lessons that George S. Clason seeks to impart, making it easier for readers to understand and apply these lessons in their own lives.

It costs nothing to ask wise advice from a good friend.

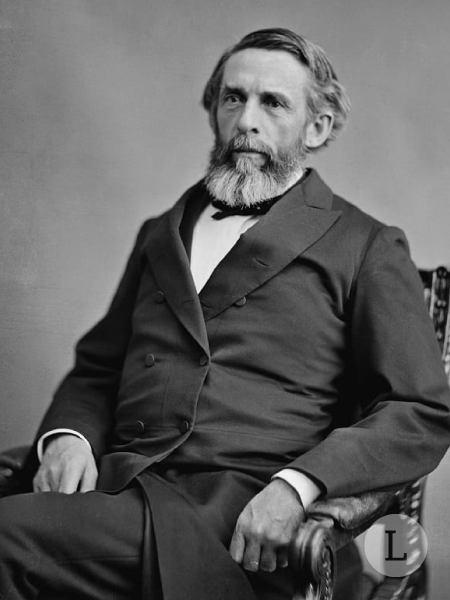

GEORGE S. CLASON

TOP 10 POINTS

- Pay Yourself First: The Richest Man in Babylon emphasizes the importance of saving at least 10% of your income before addressing any other expenses, teaching readers to prioritize savings and investments as a key to wealth-building.

- Control Your Expenses: The book advises living within your means and avoiding unnecessary expenditures, emphasizing the importance of financial discipline and budgeting in achieving financial stability.

- Make Your Money Work for You: Clason highlights the significance of investing wisely and prudently to generate passive income, allowing your money to grow and multiply over time.

- Protect your Wealth: The book teaches readers the importance of diversification and risk management in safeguarding their assets and ensuring financial stability.

- Increase Your Earning Potential: The Richest Man in Babylon underscores the value of continuous self-improvement and learning, encouraging readers to enhance their skills, knowledge, and abilities to maximize their earning capacity.

- Seek Professional Advice: Clason advocates consulting with financial experts and mentors to make informed decisions about money management and investments, ensuring that your financial choices are well-founded and strategic.

- Ensure a Financial Legacy: The book promotes long-term planning and the importance of leaving a financial legacy for future generations, teaching readers to consider not only their immediate needs but also the financial security of their family.

- Timeless Wisdom: The Richest Man in Babylon offers timeless financial principles and advice that remain relevant and applicable, even decades after its initial publication.

- Engaging Storytelling: The book presents its financial lessons through captivating parables set in ancient Babylon, making the content more accessible and enjoyable for readers.

- Accessible to All: Clason’s work emphasizes that anyone, regardless of their starting point, can achieve financial independence and success by diligently following the principles outlined in the book and maintaining discipline, patience, and consistency in their financial endeavors.

In conclusion, The Richest Man in Babylon is a timeless and insightful work on personal finance that offers valuable lessons and practical guidance for anyone seeking to improve their financial situation and achieve lasting prosperity. Through its engaging parables and straightforward principles, the book has inspired countless readers to take control of their finances and work towards a more secure and prosperous future.

ABOUT WRITER

George Samuel Clason was an American author, entrepreneur, and publisher who gained widespread recognition for his series of financial parables set in ancient Babylon. Clason’s accessible storytelling and timeless financial advice have made his works popular and enduring classics in the realm of personal finance literature. His most famous work, The Richest Man in Babylon, continues to inspire and guide readers in their pursuit of financial success and independence.